The business-to-business (B2B) payments market is growing rapidly, and the use of digital payment solutions is increasing among businesses. B2B payments are transactions involving businesses rather than individual consumers. They involve selling products or services directly to other businesses rather than end-users.

The scope of B2B payments extends from suppliers selling wholesale goods to vendors providing services to other companies. With the growing popularity of online business transactions and b2b merchant service, B2B payment methods have also evolved. E-commerce transactions require secure and convenient payment solutions. Digital payment solutions are becoming more common in the B2B sphere as a result. Businesses need fast and secure ways to pay vendors and vice versa. This article explores the best B2B payment solutions and providers available today and tomorrow.

What is the Best B2B Payment Solution?

The best B2B payment solution for your business will depend on the industry you’re in, the number of transactions you process per day, and the number of employees you have to process those transactions. You should also consider any integrations or data partnerships you have with your bank or payment processor.

When choosing a payment solution, you should first decide whether you want a hosted or an on-premise payment solution. A hosted solution is hosted by a third party and an on-premise solution is hosted internally within your organization. Hosted solutions are often recommended for small businesses as they are easier to set up and have a lower upfront cost.

Digital Wallet for B2B Payments

A digital wallet enables businesses to accept payments remotely by swiping cards, scanning QR codes, or entering card information online. Companies usually use digital wallets for B2B payments. A major advantage of digital wallets is that they eliminate the need for businesses to handle paper checks.

Electronic Payment Solutions

Electronic payment solutions use electronic transfers between banks or financial institutions to transfer money between parties. In addition, electronic payment solutions are fast, but they are not always suitable for B2B payments. For example, ACH transfers take two to five days to process. Some B2B payment providers offer near-real-time payment solutions with guaranteed funds availability.

Blockchain for B2B Payments

Blockchain technology is disrupting every industry today, and it is also disrupting the B2B payments market. Blockchain-based B2B payment solutions provide trusted, traceable, and secure transaction records and settlement times. They also have lower transaction costs and eliminate the need for intermediaries.

FDIC Banking Certification for B2B Payments

The Federal Deposit Insurance Corporation (FDIC) is a government-backed organization that ensures funds in bank accounts against the risk of loss. Banks that are insured by the FDIC are referred to as “insured banks.” If a B2B business relationship involves transferring money between banks not insured by the FDIC, the funds may not be protected against the risk of loss. This can be an issue if the receiving bank goes out of business or if there is a natural disaster that damages the bank’s premises.

Conclusion

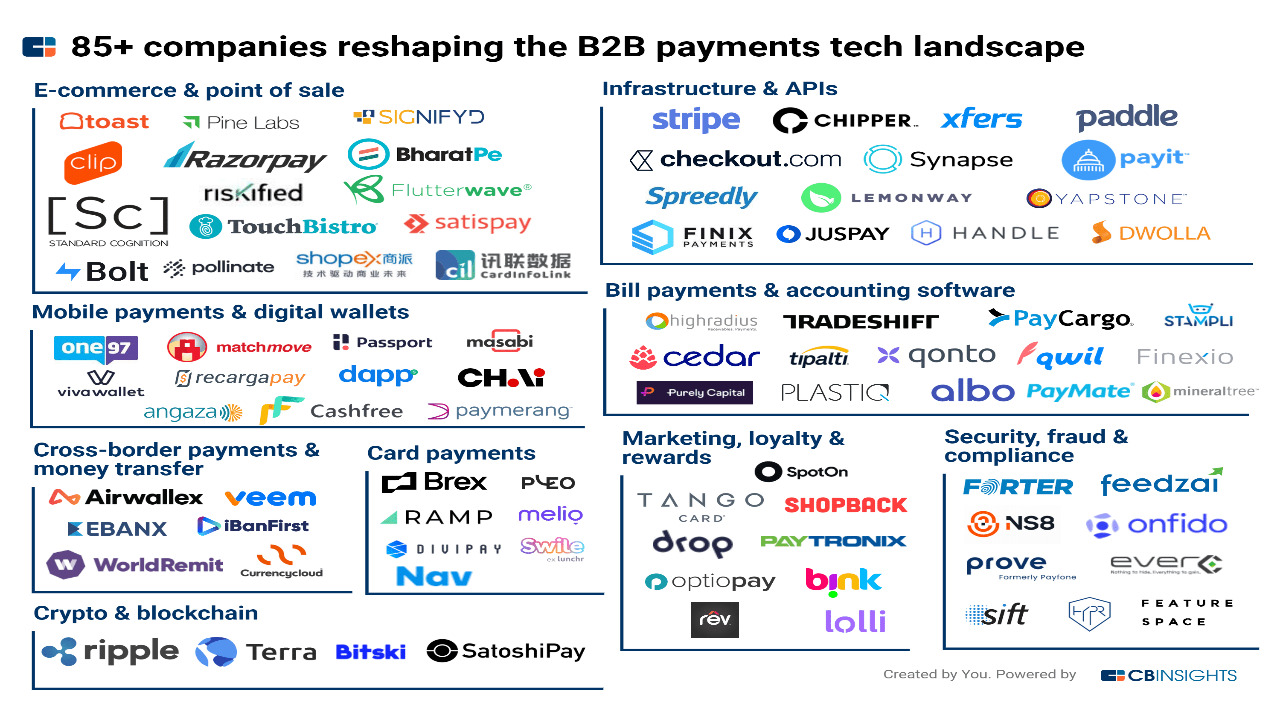

B2B payments are growing in popularity and being conducted in new ways. Digital wallets, blockchain technology, and other innovations are changing the B2B payments landscape. Businesses can choose from a wide range of payment solutions to facilitate faster and more secure B2B payments.